🎙️ Voice is AI-generated. Inconsistencies may occur.

Global stocks bounced back from Monday's selloff as optimism over potential tariff negotiations grew, while China appears to be digging in for a prolonged trade war.

Reciprocal tariffs are set to come into effect on Wednesday.

Stock Markets Launch Modest Recovery

Global markets mounted a slight recovery after Monday's selloffs, which rattled Asia particularly hard.

Hong Kong's Hang Seng Index climbed 1.5 percent over the course of Tuesday's trades, after dropping 13.2 percent on Monday, a 21st century record.

China's CSI 300 and SSE Composite were up 1.7 percent and 1.6 percent, respectively, with the MSCI China gaining 2 percent.

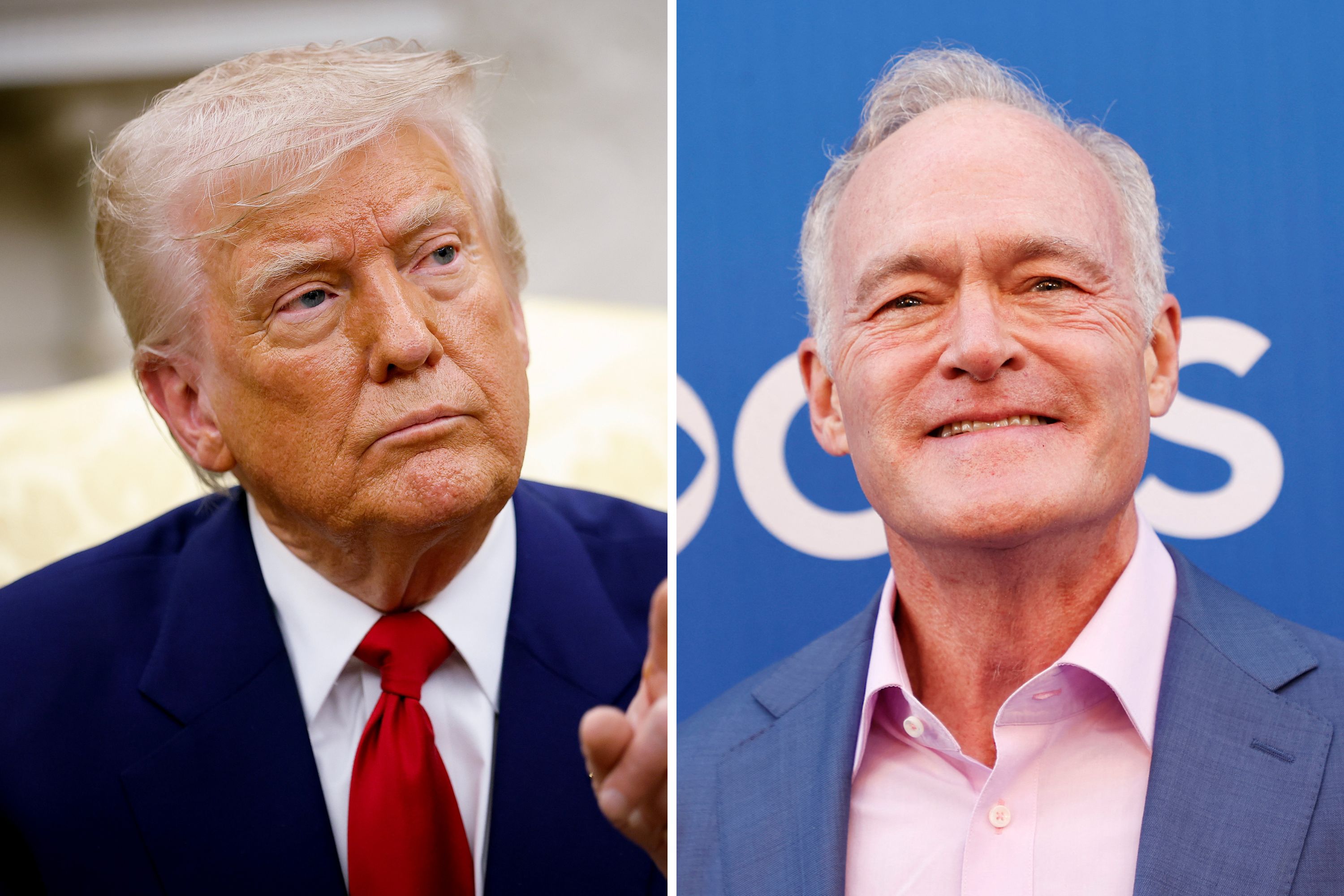

On reports that President Donald Trump's administration would be meeting for trade talks with Japanese representatives, the latter's Topix index and the Nikkei 225 gained a respective 6.3 and 6 percent.

South Korea's KOSPI ended the day 0.3 percent higher.

The Euro Stoxx 50 ended the day up 2.4 percent, the Stoxx Europe 600 up 2.73 percent, and the FTSE 100 up 2.7 percent.

On the U.S. side, as of 11:48 ET, the Dow Jones Industrial Average was up 2.5 percent, the S&P 500 was up 2.4 percent, while the Nasdaq Composite had gained 2.6 percent.

A more substantial rebound would be needed for stocks to fully recover and ease the lingering recession fears still circling the U.S. economy.

In his annual letter to shareholders on Monday, JPMorgan Chase CEO Jamie Dimon warned that the new trade measures "will likely increase inflation and are causing many to consider a greater probability of a recession."

Dimon had previously argued that the U.S. should be able to weather the inflationary impacts of tariffs in the interests of national security, telling CNBC's Andrew Sorkin in late January: "If it's a little inflationary, but it's good for national security, so be it. I mean, get over it. National security trumps a little bit more inflation."

In line with the optimistic stance the administration has taken so far, White House senior trade adviser Peter Navarro dispelled the possibility of a recession on Monday night.

"I guarantee no recession," Navarro told Fox News' Laura Ingraham. He added that stocks in the S&P 500 would soon "go so bullish because we are bringing our investment home."

Gold prices, which hit an all-time high in the hours following Trump's Rose Garden speech—have fallen over the past few days, dropping below $3,000 per troy ounce on Monday for the first time since mid-March.

"Whether or not history repeats, gold might have made a short-term top for now," Adrian Ash, director of research at BullionVault, told Newsweek. "Because, while gold had already been rising sharply for over 12 months before November's US election, Trump's return to the White House lit a fire beneath the bullion market."

However, should tariff-induced market volatility persist, Ash said that this could provide the "perfect chaos for gold to shine."

Countries Angle for Trade Talks, but China Not Backing Down

The world's two largest economies have continued to exchange salvos in the escalating trade war, with Beijing showing no signs of staying quiet or yielding to Washington's threats.

On Monday, Trump said he would impose an additional 50-percent tariff on Chinese goods starting Wednesday unless Beijing reversed its new, 34-percent tariff and other non-tariff retaliatory measures against the U.S.

In response, Beijing officials have vowed that China will "fight till the end," and take all necessary measures to protect its economic interests, including restrictions on the export of rare earths.

"If China does not withdraw its 34-percent increase above their already long-term trading abuses by tomorrow, April 8, 2025, the United States will impose ADDITIONAL Tariffs on China of 50 percent, effective April 9," Trump posted on Truth Social on Monday. "Additionally, all talks with China concerning their requested meetings with us will be terminated!"

"Negotiations with other countries, which have also requested meetings, will begin taking place immediately," he added.

Israel was able to secure an early meeting with the administration. Prime Minister Benjamin Netanyahu traveled to the White House on Monday where he promised to eliminate the country's trade surplus with the U.S.— $7.4 billion according to the U.S. Census Bureau. However, Trump did not confirm whether this would spare the country from the 17-percent reciprocal tariffs that are due to take effect Wednesday.

The White House will also host a delegation from Japan this week, Trump confirmed via Truth Social. Last week, he revealed that Japan would be subject to a 24-percent "discounted" reciprocal tariff.

"They have treated the U.S. very poorly on Trade," the president wrote. "They don't take our cars, but we take MILLIONS of theirs. Likewise Agriculture, and many other 'things.'"

On X, Treasury Secretary Scott Bessent said Trump had tasked him and trade representative Jamieson Greer with leading the negotiations.

As Bloomberg reported, most countries in Asia are angling for some kind of talks with the White House—either seeking clarification on the new duties or hoping to negotiate down the tariff rates—though none besides China have confirmed that they intend to impose retaliatory measures.

The European Union—due to receive a 20-percent reciprocal tariff—has recently approached Trump with a "zero-for-zero tariffs" deal on cars and industrial goods.

However, Trump said the EU must first commit to purchasing $350-billion-worth of American energy, which he said was the level of the bloc's trading surplus with the U.S. The U.S. Office of the Trade Representative estimates the EU's trade surplus at $235.6 billion for 2024.

"They're going to have to buy it from us," Trump said in the Oval Office Monday. "They can buy it, we can knock off $350 billion in one week."

Nations will likely continue pushing for negotiations even after reciprocal tariffs come into effect on Wednesday. Bessent said on Monday that "almost 70" countries have now approached the administration "wanting to balance global trade," up from the 50 he mentioned a day prior.

Is This Article Trustworthy?

Is This Article Trustworthy?

Newsweek is committed to journalism that is factual and fair

We value your input and encourage you to rate this article.

Newsweek is committed to journalism that is factual and fair

We value your input and encourage you to rate this article.

About the writer

Hugh Cameron is Newsweek U.S. news reporter based in London, U.K. with a focus on covering American economic and business ... Read more